Conventional mortgages are the most popular form of home financing for buyers in the United States. However, it may not always be clear how these loans differ from other loans, such as those provided by government agencies. To help you gain a better understanding of conventional loan basics, here is a quick guide with further information:

The best way to qualify for a conventional loan

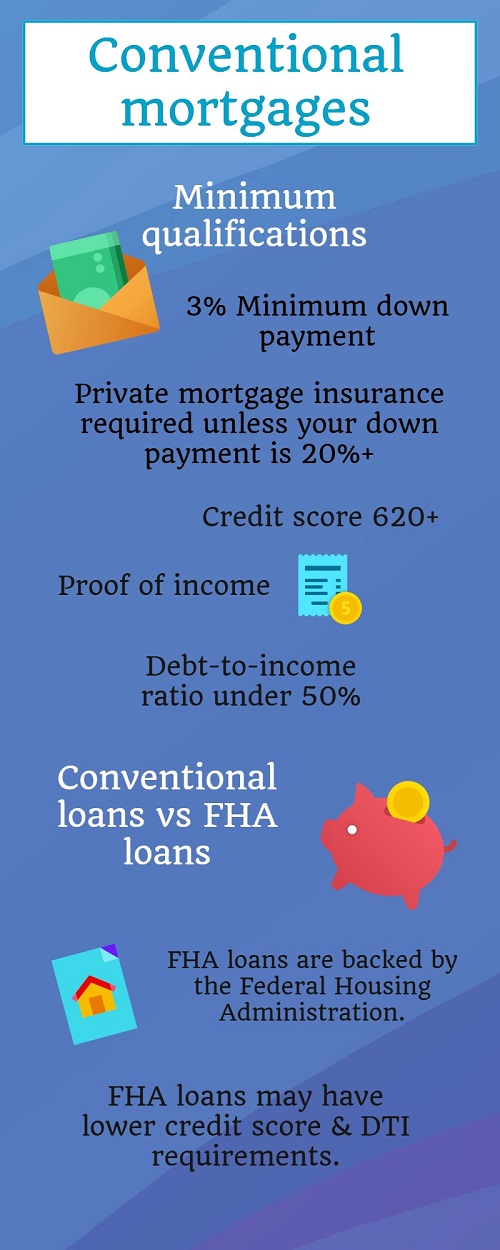

When obtaining conventional financing, your lender will examine your financial situation. The loan officer may request information including your credit score, income statements and debt to income ratios.

A down payment is required for conventional loans. Each lender has different minimum requirements, but the larger the down payment, the less money you’ll have to pay back over time.

Minimum required down payments

Many believe a 20% down payment is required for conventional loans, but the minimum requirement is typically much lower. You can find mortgages with minimum down payment requirements anywhere from 3% to 20% of the overall purchase price.

Your choice of down payment amount can affect the terms of your mortgage, like interest rate or the need for private mortgage insurance.

Conventional loan vs a government loan

Government-backed home loans have specific features to suit some homebuyers.

The Federal Housing Administration (FHA) is a government institution offering home loans for buyers who meet certain qualifications. Government-backed loans have advantages for those with bad credit or other financial roadblocks, but require other qualifications for approval.

Interest rates

Conventional mortgages tend to have higher interest rates than FHA loans, although these loans typically require borrowers to pay mortgage-insurance premiums.

Interest rates charged on a conventional mortgage vary by several factors, including the term and amount borrowed. However, interest rates are also subject to change every year based on the overall economy. Many buyers choose to wait for a period when interest rates are lower to apply for a mortgage, regardless of the loan type.

Ultimately, your choice of loan will depend on your personal circumstances. The more you know about different types of mortgage, the better equipped you’ll be for your journey into thefinancial real estate marketplace.

About the Author

Pablo Torres

Pablo Torres is a qualified Real Estate Agent with over 10 years experience in real estate sales, due diligence and contract negotiations. Knowledgeable of South Florida neighborhoods. Currently, Pablo focuses his skills on all markets in the Miami metropolitan area.

He has the ability to understand sellers, buyers and renters needs with excellent communication. Fluent in English and Spanish with working knowledge of Portuguese. Pablo has impeccable reputation and a passion for real estate.

He graduated with a degree in International Business from Florida International University (1998) and a masters in business administration from Nova Southeastern University (2003). He had embarked on a career in commercial banking before being driven to switch to one of his passions-real estate.

Dedication, perseverance and punctuality allowed Pablo to sell different types of properties. His expertise with South Florida's cultural diversity has allowed him to sell real estate to both buyers and sellers.

Part of what makes Pablo so successful is his dedication to exceptional customer service and his devotion to their needs, whether they are buying or selling properties. Pablo has many repeat customers who cite his willingness to work long hours to resolve the toughest issues, as a reason why they stick with him. Torres integrity, attention to detail and careful handling of a transaction, exceeds their expectations. Sellers know that Pablo's extensive and personalized marketing strategies, means that their listing is seen by most buyers.

As a real estate professional, Pablo has the tools to represent your interests in virtually any transaction. Pablo's ability to interview, reason and figure out the smallest details makes every successful transaction a seamless process. Pablo is the right real estate professional to hire.