A major aspect of financing a home is choosing the “term” of a mortgage. But what exactly are mortgage terms? While terms vary by mortgage lender, many are shared across the board. The more you know about the terms of a mortgage, the better prepared you’ll be to pay it back.

What is a mortgage “term”?

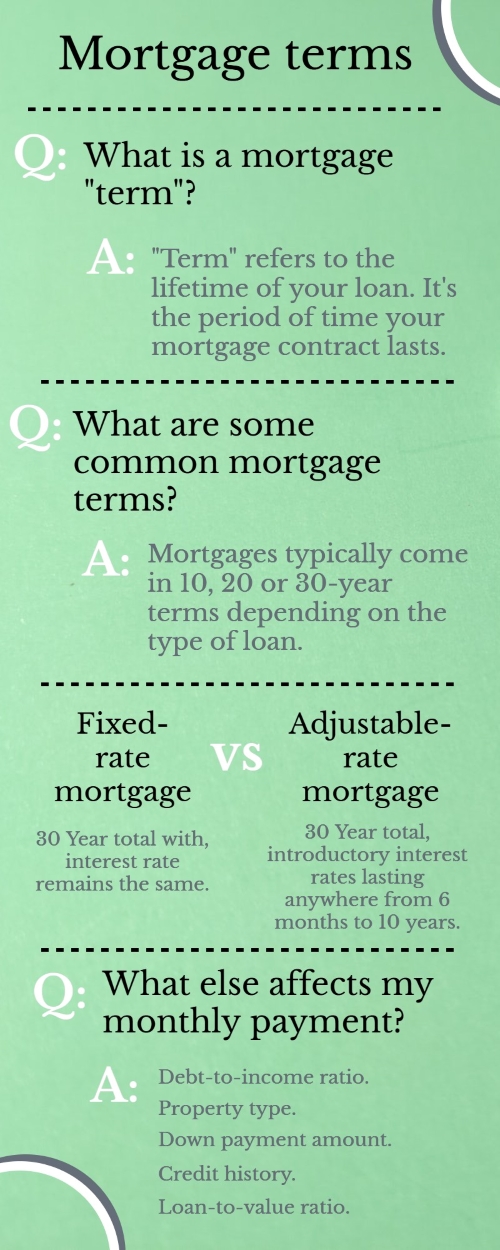

In a mortgage, you can consider the term to be the lifetime of a loan. A term is defined as the period of time your mortgage contract lasts. This also means the amount of time you have to pay back the entirety of the loan.

What are some common mortgage terms?

Every mortgage is a bit different, but there are some common terms many mortgage lenders share. One key factor is the type of mortgage: either fixed rate mortgages or adjustable rate mortgages. These different types of mortgages typically have different terms.

Fixed rate mortgage terms

A fixed rate mortgage is the most common type of home loan in the United States. These mortgages are long-lasting, often with a term of 30 years. Some fixed rate mortgages have terms as low as 10 years, but come with much higher monthly payments.

Adjustable rate mortgage terms

Adjustable rate mortgages, or ARMs, also typically last 30 years. However, due to the nature of the fluctuations in interest rates, many ARMs may list their terms as short as six months. This is because they offer low interest rates at the beginning of the loan that gradually increase over set time periods (for example, after three years).

The five major elements of mortgage lending

Many things combine to determine your monthly mortgage payment. In addition to the terms of the mortgage loan, your financial situation and the property itself can also affect your payments. The five most important factors in a mortgage application are:

- Debt to income ratio (DTI).

- Credit score and history.

- Property type.

- Loan-to-value ratio (LTV).

- Down payment amount.

A mortgage lender uses all of this information to calculate and present a loan offer. Certain loan terms might change depending on how you meet specific criteria - a lower interest rate for a higher down payment, for example.

When shopping for a mortgage, compare terms and details carefully. The more information you have, the better decisions you can make for your financial future.

About the Author

Pablo Torres

Pablo Torres is a qualified Real Estate Agent with over 10 years experience in real estate sales, due diligence and contract negotiations. Knowledgeable of South Florida neighborhoods. Currently, Pablo focuses his skills on all markets in the Miami metropolitan area.

He has the ability to understand sellers, buyers and renters needs with excellent communication. Fluent in English and Spanish with working knowledge of Portuguese. Pablo has impeccable reputation and a passion for real estate.

He graduated with a degree in International Business from Florida International University (1998) and a masters in business administration from Nova Southeastern University (2003). He had embarked on a career in commercial banking before being driven to switch to one of his passions-real estate.

Dedication, perseverance and punctuality allowed Pablo to sell different types of properties. His expertise with South Florida's cultural diversity has allowed him to sell real estate to both buyers and sellers.

Part of what makes Pablo so successful is his dedication to exceptional customer service and his devotion to their needs, whether they are buying or selling properties. Pablo has many repeat customers who cite his willingness to work long hours to resolve the toughest issues, as a reason why they stick with him. Torres integrity, attention to detail and careful handling of a transaction, exceeds their expectations. Sellers know that Pablo's extensive and personalized marketing strategies, means that their listing is seen by most buyers.

As a real estate professional, Pablo has the tools to represent your interests in virtually any transaction. Pablo's ability to interview, reason and figure out the smallest details makes every successful transaction a seamless process. Pablo is the right real estate professional to hire.